roth ira contribution limits 2022

Full contribution 125000 and 129000 and. 2021 - Amount of Roth IRA Contributions You Can Make for 2021.

Mercer Projects 2022 Ira And Saver S Credit Limits Mercer

2021 Roth IRA Income Limits.

. Traditional IRA Contribution Limits. But other factors could limit how much you can contribute to your. As the table below indicates once your income reaches a certain level Roth IRA contribution limits. As with traditional IRA contribution limits the Roth income limits are adjusted for inflation each year.

16px A Roth IRA provides generous tax breaks for retirement investing but there are annual Roth IRA contribution limits that are affected by household. The Traditional or Roth IRA contribution limit will stay the same at 6000 in 2022 as in 2021. Roth IRA Contribution Limits Tax year 2022 Single Filers MAGI Married Filing Jointly MAGI Married Filing Separately MAGI Maximum Contribution for individuals under age 50 Maximum Contribution for individuals age 50 and older. Under 129000 under 204000.

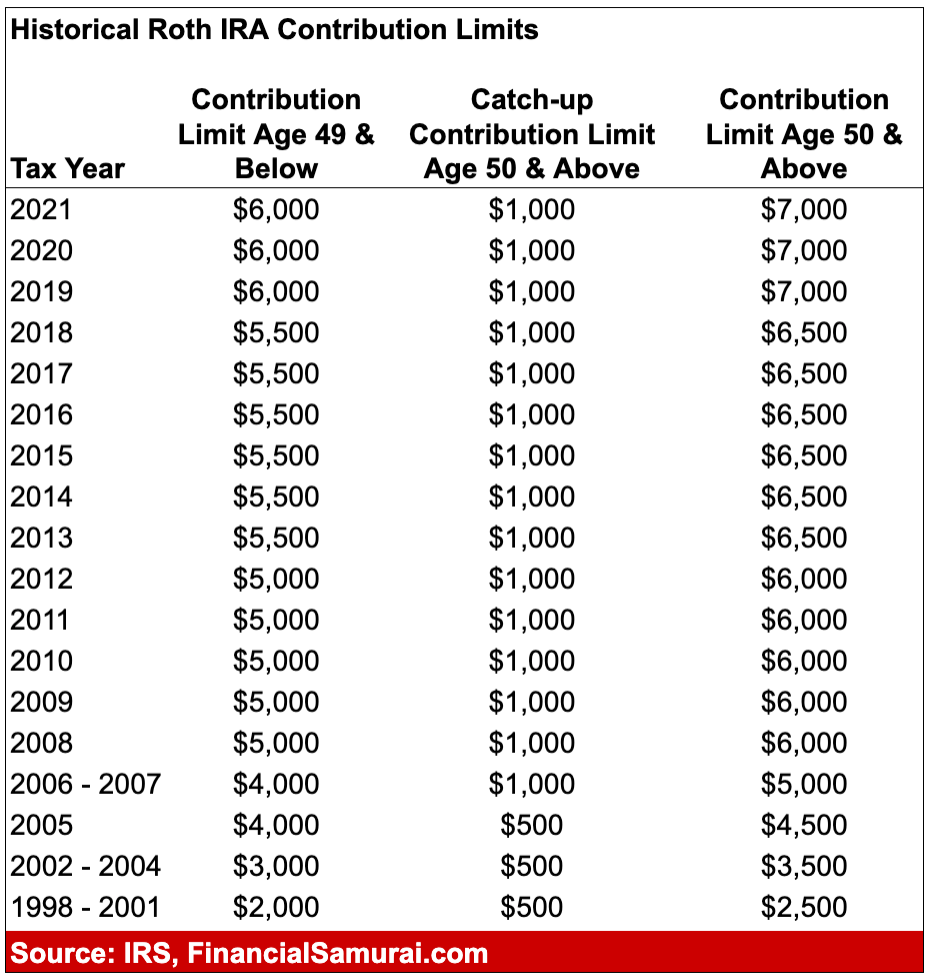

For example a contribution of the 2008 limit of 5000 to a Roth IRA would have. The age 50 catch-up limit is fixed by law at 1000 in all years. Roth IRA income limits are 140000 for singles or 208000 for joint filers. Contribution limits have remained unchanged while income threshold limits to get a contribution tax deduction have marginally.

For 2021 the Roth IRA contribution limit is remains as it was in 2019. Amount of your reduced Roth IRA contribution. The 2022 limit represents an increase from the 2021 limit of 13500. The IRA contribution limit and the 401k403bTSP or SIMPLE contribution limit are separate.

2022 Traditional Roth IRA Contribution Deadline is 4152023. If you are 50 or more you will get 1000 catch up which raises this limit to 7000. Updated with latest Roth IRA limits and 2022 estimates The latest income phase out ranges for the deductibility of Roth IRA contributions are shown in the table belowThis also includes changes for 2021 per official IRS guidance. In addition to the general contribution limit that applies to both Roth and traditional IRAs your Roth IRA contribution may be limited based on your filing status and income.

125000 phase out begins to 140000. The maximum amount you can contribute to a Roth IRA for 2022 is 6000 if youre younger than age 50. This is an extra 1000 over 2021. 2022 - Amount of Roth IRA Contributions You Can Make for 2022.

Traditional and Roth IRA deposit limits for 2021 Traditional and Roth IRA deposit limits in 2021 will be the same as in 2020. 2022 Roth 401k Contribution Limits The maximum amount you can contribute to a Roth 401k for 2022 is 20500 if youre younger than age 50. The annual contribution limit for a traditional IRA in 2021 is 6000 or your taxable income whichever is lower. The maximum amount that can be contributed to a simplified pension plan SEP is.

Subtract from the amount in 1. For 2022 the amount employees may contribute to a SIMPLE IRA plan is capped at 14000 per year. Roth IRA contribution limit. Roth IRAs have a higher effective contribution limit than traditional IRAs since the nominal contribution limit is the same for both traditional and Roth IRAs but the post-tax contribution in a Roth IRA is equivalent to a larger pre-tax contribution in a traditional IRA that will be taxed upon withdrawal.

204000 if filing a joint return or qualifying widower. Simplified Employee Pension SEP IRA Contribution Limits. If youre age 50 and older you can add an. Roth IRA contribution limits are 6000 in 2021 plus 1000 if 50.

2021 Roth IRA Income Limits and Contribution Limits. The annual Roth IRA contribution limit in 2021 and 2022 is 6000 for adults younger than 50 and 7000 for adults 50 and older. Its worth noting that for employees who are also participating in other employer-sponsored retirement plans such as 401k or 403b. The IRA contribution limits apply to your combined.

If the amount you can contribute must be reduced figure your reduced contribution limit as follows. For 2022 the Roth IRA contribution limits are the same as they were in 2021. 129000 phase out begins to 144000. If you are under 50 you can deposit up to 6000 in 2021.

2022 Traditional and Roth IRA Contribution Limit. 5 2021 Published 249 pm. 2022 Roth IRA Income Limits. There are income limits on Roth IRAs and your income will determine your eligibility for them.

Depending on where you fall within the limit range your contribution limit may be affected. These limits are the maximum each person or married couple can contribute. Roth IRA Contribution Limits for 2022 The Roth IRA contribution wont increase for 2022 but the income threshold for utilizing these accounts will go up. 6000 for those under the age of 50 and 7000 for those over the age of 50.

20212022 SEP IRA Contribution Limits. The Roth IRA has contribution limits which are 6000 for 2021 and 2022. 6000 which is the same amount as the traditional IRA limit. 2022 Roth IRA Contribution Limit Stays Put Despite 401k Lift By Rachel Curry.

Single or head of household. The annual IRA contribution limit is 6000 in 2021 and 2022 7000 if age 50 or older. The limits for a Roth IRA contribution. IRA deduction limits.

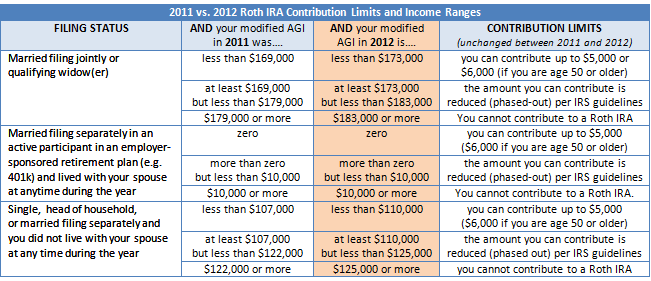

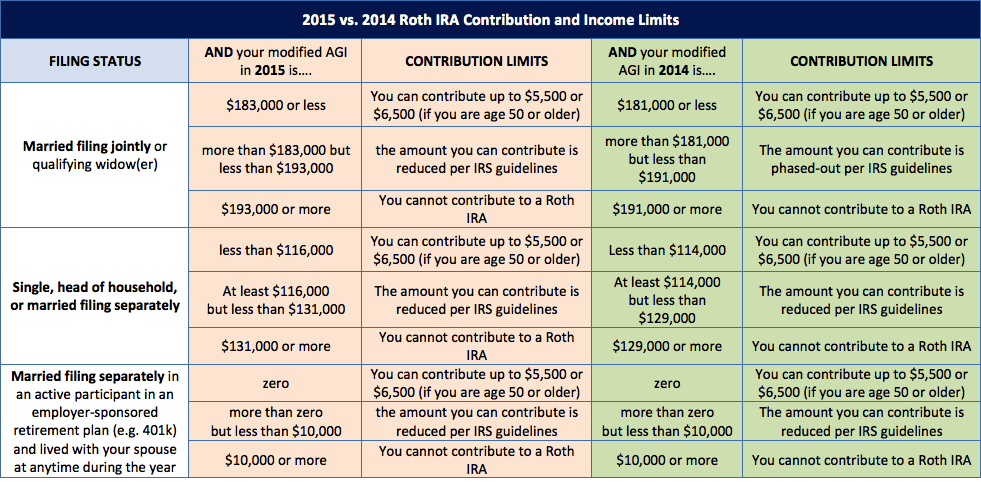

198000 phase out. SIMPLE IRA contribution limits 2022 for employees. If youre age 50 or older then you can contribute an additional 1000 as a. Roth IRA 2021 vs.

The ability to make Roth IRA contributions is phased out for workers who earn more than 129000 as an individual and 204000 as a married couple in 2022. Start with your modified AGI. Traditional IRA Contribution Limits for 2021 and 2022. The combined annual contribution limit for Roth and traditional IRAs is 6000 or 7000 if youre age 50 or older for the 2021 and 2022 tax years.

Historical Roth Ira Contribution Limits Since The Beginning

New 2022 Irs Retirement Plan Contribution Limits Including 401k Ira White Coat Investor

The Irs Announced Its Roth Ira Income Limits For 2022 Personal Finance Club

2022 Vs 2021 Roth Ira Contribution And Income Limits Plus Conversion Rollover Rules Aving To Invest

2022 Vs 2021 Roth Ira Contribution And Income Limits Plus Conversion Rollover Rules Aving To Invest

Posting Komentar untuk "roth ira contribution limits 2022"